Customer advance created for GBP 12,000 but the NTE value on the project contract header is GBP 10,000.

The customer advance invoice posted without any issues as NTE is not checked at advance level.

The NTE values on the project contract are also unaltered.

First project transaction of expense was posted for GBP 8,000, with a NTE check as "Success & Committed".

Now the next expense was posted for GBP 3000. The transaction has NTE status of "Fail and Failed".

This has posted the cost and sale transaction on the FinOps side, which is actually not correct. Only cost should have been posted. The sale accrual should not have posted as this transaction has crossed the NTE limit.

The cost and sale voucher.

The transaction which has surpassed the NTE limit, system will not allow that transaction to be invoiced.

The only option in this case is to increase the NTE limit on the project contract header and then re-evaluate the transaction for NTE limit.

The transaction re-evaluation for the NTE limit is done using this button. (Re-evaluate Not-toExceed)

Once the transaction is re-evaluated, then the transaction status changes to "Committed".

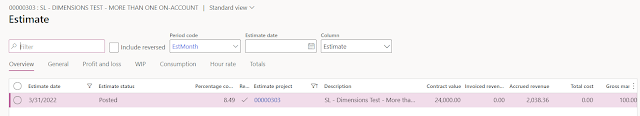

This transaction can now be invoiced. After the invoice, the remaining NTE value is as below:

Also the remaining Advance value is as below:

If the project ends now, then question is how do we return the remaining GBP 890 back to the customer.

To do this, we need to navigate back to originally posted advance invoice for GBP 12000 and click "Correct this invoice". The system is smart enough to note that it has to create a negative invoice (credit note) for ONLY the remaining value.

Once "Correct this invoice" button is clicked, the total amount is the remaining amount as seen in the screenshot.

And then the normal invoice procedure to continue.

Above step of "Correct this invoice" can also be done after the invoice is "Mark invoice as paid" is clicked.

After the confirm button is pressed, the invoice / credit note will be processed and will be posted in FinOps.

Thanks

Sarang