I just now came to know a way of reverting the SAME project transaction which is in 'Selected for credit note' back to 'Invoiced'.

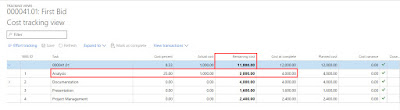

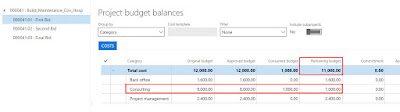

When the project transaction is invoiced, the 'Transaction status' is changed to 'Invoiced':

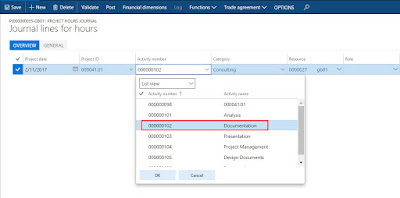

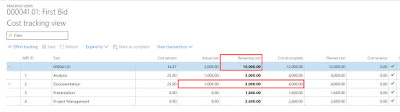

When you select the transaction for credit note, the 'Transaction status' is changed to 'Selected for credit note'

I was wondering how do i put this 'Transaction status' back to 'Invoiced' as i selected the transaction mistakenly for credit note.

I got to know this today from one of my colleague. The solution is to just run the process again and 'Deselect' the transaction, which will revert the 'Transaction status' from 'Selected for credit note' to 'Invoiced'.

When clicked 'Ok', the system reverts the 'Transaction status' from 'Selected for credit note' back to 'Invoiced'.

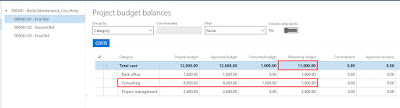

The reason for knowing this was, i was getting stuck while posting an estimate on a % complete fixed price project. The on-account transaction based on which system calculates the accrued revenue was in the 'Selected for credit note' state and hence system was giving the error :

"On account cannot be chosen for type project and ID".

Had i known this process of reverting the transaction status back to 'Invoiced' i would have been successful in posting the estimate.

Thanks

Kind Regards

Sarang